Are you curious about your financial health but unsure where to start? Your credit score is a crucial indicator of your financial wellbeing, and knowing how to access and interpret it can be a game-changer. In this comprehensive guide, we’ll walk you through everything you need to know about accessing your credit score in the UK.

The Credit Reference Agencies in the UK

Credit Reference Agencies (CRAs) in the UK play a crucial role in the financial ecosystem by providing lenders with detailed information about potential borrowers. These agencies gather data from various sources, including banks, credit card companies, and other financial institutions, to create a comprehensive picture of your credit history.

They maintain records on how individuals manage their credit and service accounts, previous UK addresses, and data from public sources like the electoral roll, court judgments, and bankruptcy information. CRAs also help verify identity, age, and residency, track fraud, combat money laundering, and assist in debt recovery. Additionally, government bodies use this data to assess eligibility for benefits and recover unpaid taxes.

There are three main Credit Reference Agencies (CRAs) that collect and maintain credit information: Experian, Equifax, and TransUnion. These 3 companies hold over 90% market share while the remaining 6 share less than 10%. However, financial technology companies like ClearScore and Credit Karma also provide free, ongoing credit score monitoring.

Each CRA plays a vital role in the UK’s credit reporting system

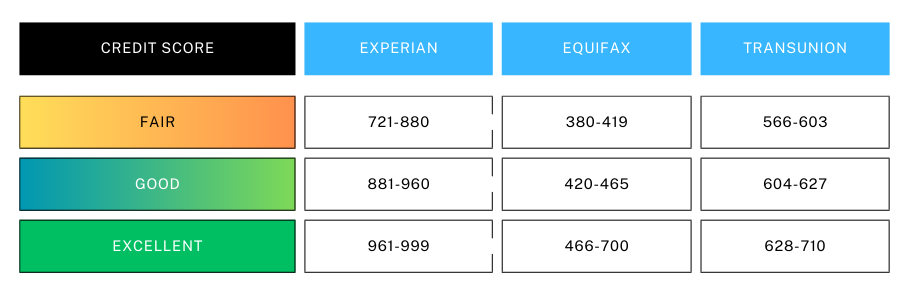

– Experian: Known for its extensive database and user-friendly interface, Experian offers both free and paid credit score services. It is the largest credit reference agency in the UK. Its score ranges from 0-999. Reference: What Is A Good Credit Score? | Experian).

– Equifax: Provides detailed credit reports and scores, with a focus on helping consumers understand their financial standing. It is the UK’s second largest CRA, and has scores ranging from 0-710. Reference: TransUnion credit score, rating and report | Finder UK).

– TransUnion: Formerly known as CallCredit, TransUnion offers credit reporting services with a particular emphasis on fraud prevention. Its scores range from 0-700. Reference: Equifax credit score, rating and report | Finder UK).

Comparing Free and Paid Services

While all three CRAs offer free services to access your credit score, they also provide paid options with additional features:

Free Services:

- Basic credit score access

- Limited credit report information

- Monthly updates

Paid Services:

- Comprehensive credit reports

- More frequent updates (some offer daily refreshes)

- Credit score improvement tools

- Identity theft protection

How Often Should You Check Your Credit Score?

Credit scores are typically updated at least once in a month, but your financial activities could determine how frequently it changes. However, checking it regularly doesn’t hurt. It just allows you to stay informed about your financial health without becoming overly obsessive.

Situations That Require Immediate Checks

Certain life events warrant an immediate credit score check:

- Before applying for a mortgage or large loan

- When suspecting identity theft

- After paying off a significant debt

- Before a job application (some employers check credit scores)

Consequences of Infrequent Checks

Neglecting to check your credit score regularly can lead to:

- Undetected errors on your credit report

- Missed opportunities to improve your score

- Potential fraud going unnoticed

- Surprises when applying for credit

Key Components of a Credit Report

A typical UK credit report includes:

- Personal information (name, address, etc.)

- Credit accounts and payment history

- Public records (e.g., bankruptcies, insolvency, county court judgments)

- Recent credit applications

- Financial associations (joint accounts)

How to Interpret the Data

When reviewing your credit report:

- Look for consistent on-time payments

- Check for correct account balances

- Ensure all listed accounts belong to you

- Review the length of your credit history

Identifying Red Flags

Be on the lookout for these warning signs:

- Accounts you don’t recognize (potential identity theft)

- Late payments or defaults

- High credit utilization (using a large portion of available credit)

- Numerous hard inquiries in a short period

How to Access Your Credit Score in the UK

You have the right to request a copy of your credit reference file from any UK Credit Reference Agency (CRA) at no cost. Here’s how to do it:

- Requesting Your File: You can request your credit reference file verbally, in writing, or through an online form provided by the CRA. If making a verbal request, it’s encouraged to follow up with a written one to create a clear record of your request.

- What to Include: When making a written request, include your full name, any names used in the last six years (e.g., maiden name), full current address with postcode, any previous addresses from the last six years, and your date of birth. Sending the letter by recorded delivery is recommended for proof of submission.

- Response Time: The CRA must respond within one month of receiving your request. If more information is needed, they may request documents like a utility bill or bank statement for identity verification. In some cases, they may take up to an additional two months, but they must inform you within the first month if more time is needed.

- Important Tips: Keep copies of all correspondence and be ready to provide additional documentation if requested. This process helps ensure your data is secure and prevents unauthorized access to your credit information.

The addresses of the CRAs are:

Experian Ltd

Customer Support Centre

PO Box 9000

Nottingham

NG80 7WF

0800 013 8888

http://www.experian.co.uk/

Equifax Ltd

Customer Service Centre

P.O. Box 10036

Leicester

LE3 4FS

0800 014 2955

http://www.equifax.co.uk/

TransUnion

Consumer Services Team

PO Box 491

Leeds

LS3 1WZ

0330 024 7574

https://www.transunion.com/

You’re taking a crucial step towards financial empowerment by understanding how to access and interpret your credit score. Regular checks and responsible credit management can help you maintain a healthy score and unlock better financial opportunities.

Have you checked your credit score recently? What surprised you most about your report? Share your experiences in the comments below!